Happy Tuesday! Market intelligence in a few words...est. 2-3 minute read.

This is a FREE Preview of the Anderson Exports - Newsletter Pro, our premium monthly subscription!

To receive actionable intelligence, premium market data, & industry analysis EVERY 2 weeks, please click to subscribe to NEWSLETTER PRO!

Primary Thoughts: Almond Export Recovery May Get Complicated

The California Almond Export industry is booming, and recent shipments have recovered to pre-pandemic norms, exceeding historical norms in December 2023 - per the most recent shipment data from the Almond Board of California.

The only higher shipments in any December in recent years were seen in the 20/21 season after the pent-up demand / high carry-out from the Pandemic.

This is good news for California’s almond exporters, showing demand remains high, even against the backdrop of a strong US dollar and the recent shipping issues in primary transit lanes such as the Panama Canal due to drought and the Red Sea area from ongoing hostilities stemming from the October 7th attacks in Israel.

Much media attention has been given to transitory negatives like inflation, the costs of shipping increasing, and weak currency pairing against the US dollar - these are all traditionally headwinds for US agricultural exports.

It remains to be seen if these issues will affect future almond exports or not, only time will tell.

Reality Check: Even the pandemic, a once-in-a-lifetime disruption, did not END global shipping, the import/export trade, nor reduce US almond exports generally over the long term.

The world is a dangerous place and it always has been, risks and opportunities are ALWAYS present, it just depends on what you want to see.

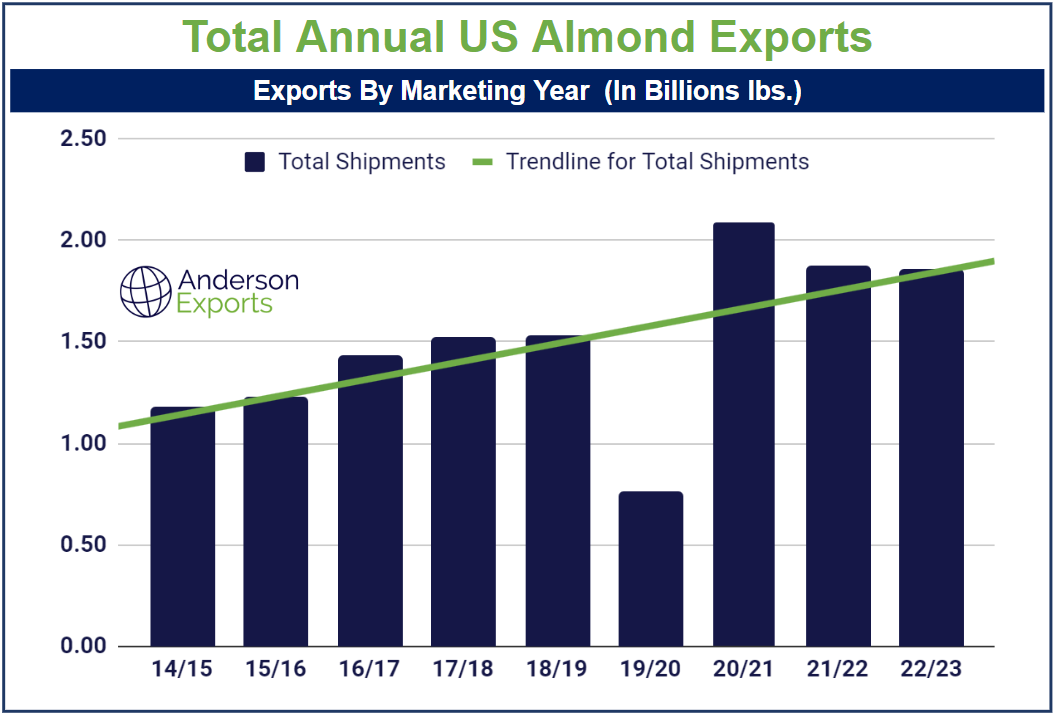

Year-over-year Total US almond exports remained even, showing a slight decrease from the 2021/2022 marketing year over the most recently completed 2022/2023 marketing year.

Even though shipments have recovered thus far in the 2023/2024 marketing year, last year saw many headwinds such as currency fluctuations, inflation, and increased shipping costs that all may have contributed to stagnant export growth.

This is not a surprise as we have seen the world rebound from the global pandemic with supply chains adapting to the newest market realities.

It is worth noting, that every year since the pandemic has generated substantial growth when compared to PRE-PANDEMIC levels.

This means BOTH California’s almond production AND the world’s appetite for this specialty tree nut continue to GROW despite all these headwinds.

California almond producers continue to refine the efficiency & efficacy of almond processing, leading to some of the lowest levels of loss & exempt product ever.

These improvements in efficiencies help to improve productive margins for shellers and exporters as well as increase the total production available for export.

As can be seen in the graphic above, the total crop size for the 2022/2023 marketing year is the lowest in the past 3 years, although still slightly higher than before the pandemic.

We expect the smaller crop size from last year has affected the carry-in for this year, leading to strong early season shipments, with higher prices, and less total availability for export grade NPX #1 as the marketing year progresses.

Newsletter Pro: provides you with exclusive market data, with an insider's look at the US ingredient export markets and global macro trends.