Major Currency Differences Contribute to Export Issues

The United States Dollar (USD) remains strong globally; the US dollar continues to appreciate against other currencies with the US dollar Index increasing 15% since June 2021.

A strong dollar may reflect solid fundamentals of the US economy, but it makes all US exports more expensive to regular importers overseas.

Americans will love spending their dollars in London and Europe, while US domestic producers are forced to cut costs and shave profit margins to compete with other origins.

While a strong dollar creates some market turmoil, it continues to prove to international investors the value of US based assets.

California In-Shell Walnut Prices Down

California’s inshell walnut exports are off to a rocky start as we have seen slow forward sales in the face of a strong US dollar.

Turkey is historically one of the top destinations for California in-shell walnuts and major currency differences between the TRY and USD continue to put downward pressure on prices.

With traditionally major players sidelined, California in-shell walnut shipment numbers for the 2022 / 2023 marketing year will likely be off to a slower start than past years.

Downward pressure on opening prices could be due to a number of factors like currency differences, increased shipping costs, and others.

The difficult thing to know at this stage is if price decreases reflect a strong dollar where demand surfaces at the right price levels or if recent price decreases represent weaker demand generally.

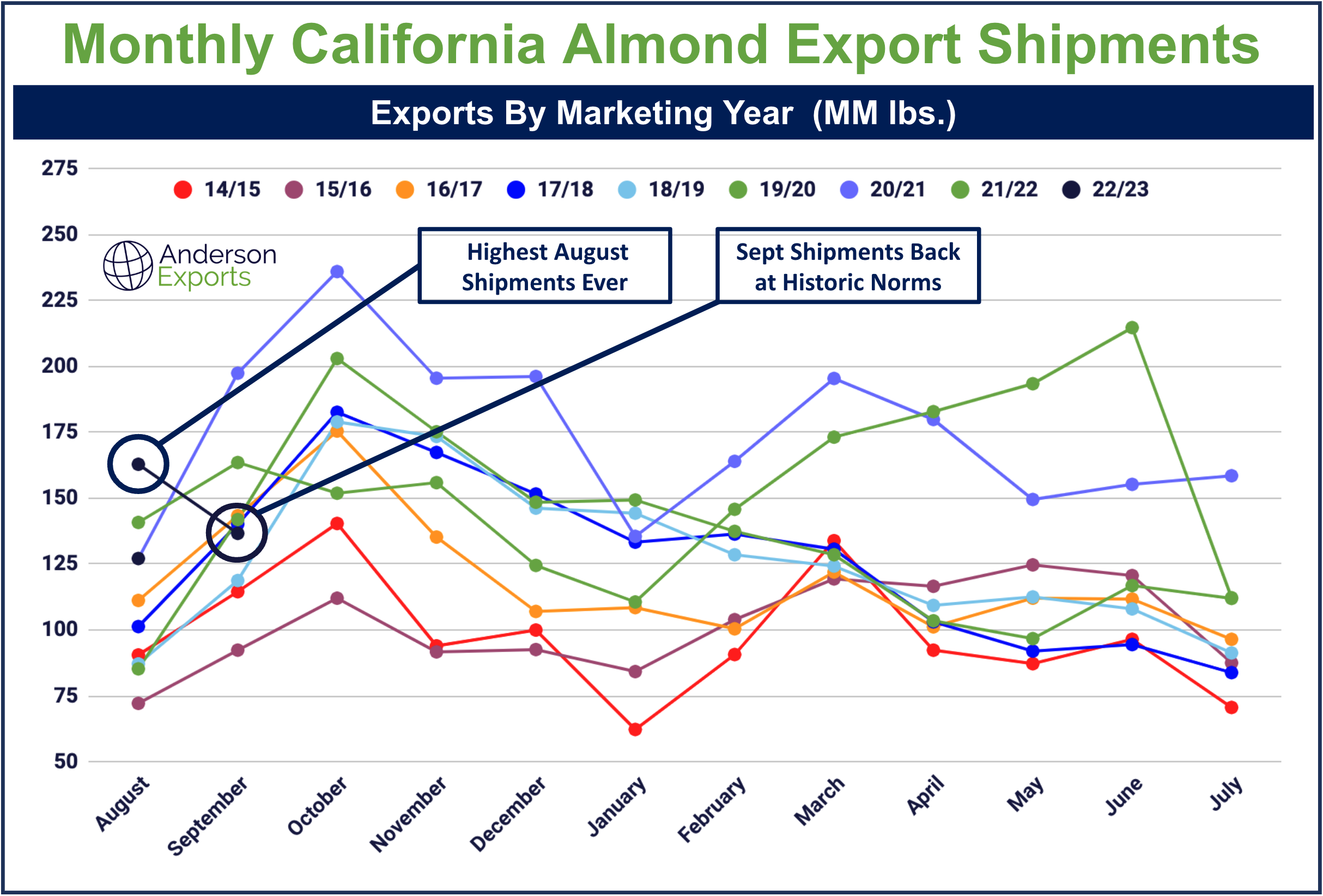

Almond Shipments “Normal” in September

A record number of almonds were exported from California in August, with September landing back in more “normal” territory.

A “normal” month like September may hide an abnormal marketing year like 2021/2022; export shipments for the 21/22 marketing year were back loaded, bucking historic trends

This shows shipments have recovered but may now be following a much more erratic and unanticipated trajectory due to several kinetic pressures.

This could mean good news for almond shippers on an annual basis, although the first half of the marketing year may provide less than anticipated cash flows.

California’s 2022 almond forecast is down over last year - 2022 production is forecast at 2.60billion meat pounds, down 11 percent from last year’s crop of 2.92 billion meat pounds.