Almonds

Many packers are reporting from the fields that the recent NASS USDA Objective Measurement Almond Report for 2020 is in line with internal expectations for a crop of 3.0 billion lbs. There is little doubt this will be a record breaking production year for California almonds. This record breaking crop size in combination with the recent COVID related disruptions of export products will create a buyer’s market this fall.

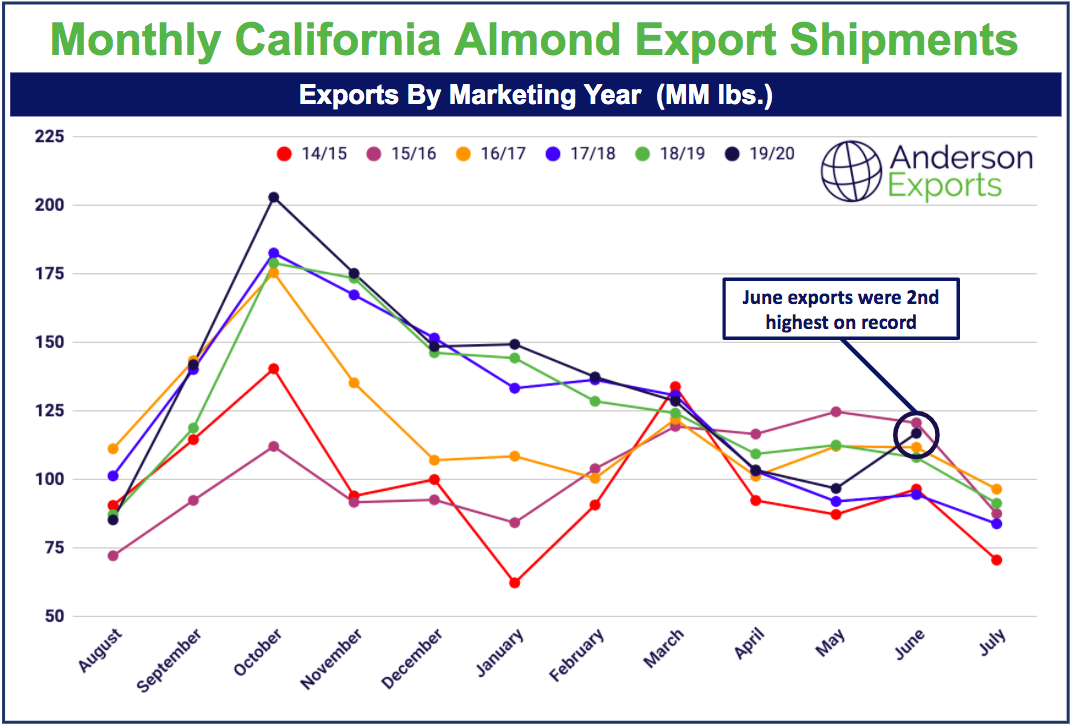

As you can see from the June 2020 Almond Board of California Position Report, California almonds have seen a marked recovery from lows in April and May to the 2nd highest export shipments seen in any recent June.

Periods of favorable pricing in combination with a large crop tend to have positive long-term effects for the larger market. Intuitively, lower prices may mean lower margins, but counter-intuitively, in the long-term the primary lagging benefit of lower pricing means California Almonds may be more accessible to a larger spectrum of buyers, therefore opening new global markets, often permanently.

While it seems almond prices will open reasonably for the 2020 / 2021 marketing year, it could be argued that the year may close with higher prices than normal. If California almonds reach both new and current global markets and monthly shipments reach new international highs through 2021 then, as Bill Morecroft and Blue Diamond note, “Demand in the U.S. could have even more future upside since the U.S. is earlier in the recovery process than the other developed economies.” If these predictions bear out in 2021, we may only continue to see the meteoric rise of global almond appetites in step with continued investments in California.

Our most popular almond varieties are Nonpareil, Independence, Butte/Padre, and Carmel types with the most popular grades of Supreme, Extra, Standard 5%, and more. Walnuts California Walnuts have seen decreases in total year-to-date shipments as a result of a complex set of factors largely related to COVID-19 related disruptions, high 2019 / 2020 opening prices, and increasing competition from alternative origins in California’s traditional export markets.

Walnuts

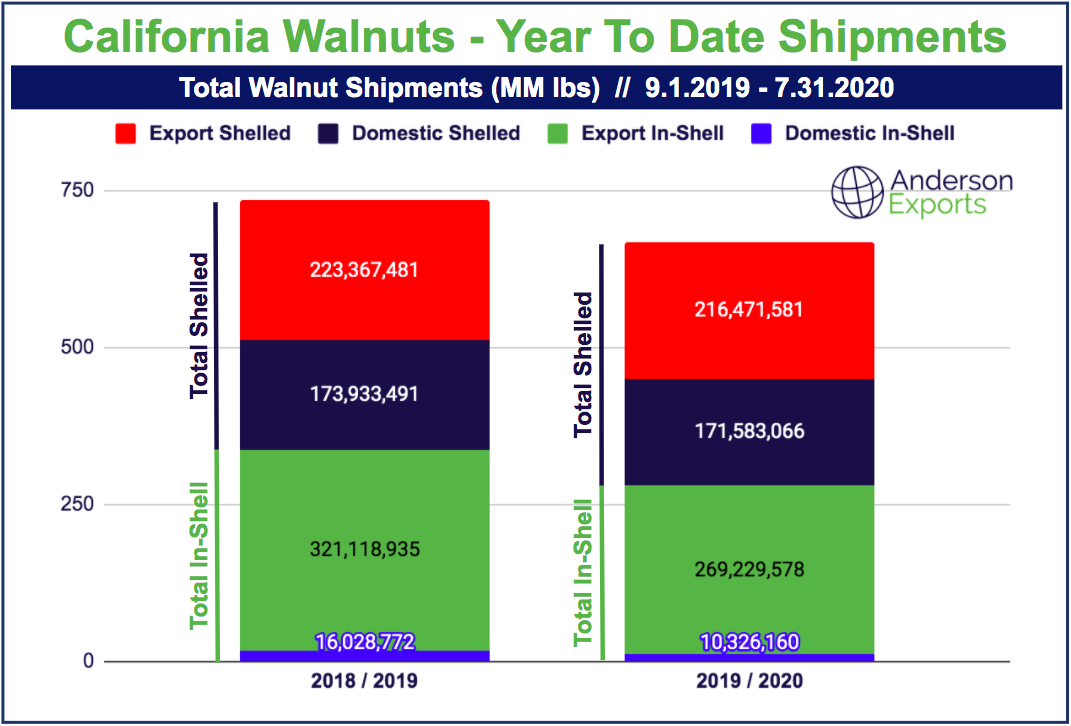

California Walnuts have seen decreases in total year-to-date shipments as a result of a complex set of factors largely related to COVID-19 related disruptions, high 2019 / 2020 opening prices, and increasing competition from alternative origins in California’s traditional export markets.

When observing the lower shipments in 2019 / 2020 over this time last year, the immediate thought is that COVID-19 seems like the most likely culprit. But upon closer inspection, we see that although Total YTD In-Shell shipments are down markedly, shelled shipments are only down slightly. Further, most in-shell shipments are completed earlier in the year than shelled shipments, so should have avoided the worst effects of the recent global slowdowns. Therefore, it seems something else must be related to the lower total in-shell shipments specifically.

Perhaps what we are witnessing is what could be described as Middle-Stage Global Production Diversification (GPD). I would describe Global Production Diversification as a rough scale between; monopolistic power over global production (Early-Stage GPD) and widespread, decentralized, price-driven global production (Late-Stage GPD). A good set of examples from within California would be:

Early-Stage GPD - Almonds are a good example of Early-Stage GPD due to the dominant, nearly monopolistic, position California maintains producing approx. 80% of the World’s almonds.

Middle-Stage GPD - Walnuts are a good example of Middle-Stage GPD since California still remains one of the largest producers while other regions are beginning to win increasing market share - origins like China are just beginning their investment and upward trajectory for walnut exports.

Late-Stage GPD - Raisins are a good example of Late-Stage GPD since production is almost entirely price-driven by fierce global competition between nearly equal or increasingly similar regional outputs from the USA, Turkey, Iran, and China.

If the lower total YTD in-shell shipments are the result of Middle-Stage GPD, then California’s traditional buyers may be beginning to substitute other growing regions into their annual purchasing decisions. Unfortunately for California’s walnut growers - evidence for this substitution is already available. Turkey, California’s largest traditional in-shell export market, is increasingly filling their needs with a lower priced Chinese product.

California’s opening prices for the 2020 / 2021 marketing year would do well to take note of these pricing dynamics and open at reasonable levels. California walnut crop looks to be developing quite well with many sellers waiting to offer larger sizes (32mm+, 34mm+) until after the Objective Walnut Measurement Report is released near the end of August / beginning of September.

Across the Pacific, the harvest for Xinjiang, China’s 185 new crop walnuts will likely have a small increase over last year. Reports from the fields indicate the new crop was not affected by bad weather as it was at this time last year and therefore the quality is expected to be higher than last year.

Demand for Chinese walnuts was large last year and we expect this will only grow in the coming seasons.

We work with the best California walnut packers to supply our customers with Jumbo and Jumbo / Large (J/L) in-shell Chandler, Howard, Hartley, Vina, Tulare, Serr and other varieties. We also provide bleached in-shell walnuts in addition to California shelled product including Chandler and non-Chandler Light Halves & Pieces (LHP) 20%, 40%, 80% and higher based on customer requirements. We also supply Combo Halves and Pieces (CHP) and Light Sorted Pieces (LSP).

Raisins

The June 2020 Raisin Administrative Committee Shipment Report was recently released, showing significant and positive growth trends for California Raisin sales. Domestic shipments were up +27% over this time last year while Exports were up +16%.

The USA continues to be California’s largest market, representing some 72% of all shipments in the 2019 / 2020 marketing year. Exports, nearly ⅓ of total shipments (28%), have risen in the most important markets in signs of growing confidence with California’s quality and market premium.

California, Turkey, and Iran, which are typically the largest producers of raisins, are seeing increasing competition from China as price and quality become competitive. China will have a real opportunity to fight for market share with the increasingly good quality of Turkish raisins. Europe’s discount buyers have been quick to recognize the value of Chinese raisins which will continue to drive the competitive market dynamics between the world’s largest raisin producers.

Reports from the fields in China’s Xinjiang region is that the harvest this year will see grapes developing well due to abundant sunshine and rainfall. Quality looks great.

The new crop of Turkish Raisins is developing well despite erratic weather conditions. We have heard that some important growing areas faced significant damage to vineyards due to hail and heavy rains. Despite this, we believe Turkey will ultimately have a good crop.

We supply all major bulk California raisins including dried-on-the-vine (DOV) and tray-dried Natural Thompson Seedless Selects, Selma Petes, Flames, Goldens, and other varieties in Jumbo, Select, and Midget sizes and welcome your inquiries. We also supply Selma Pete DOV Double-Run Supreme raisins to Japan and elsewhere which are processed twice to achieve exceptionally low stem and capstem counts. We offer multiple packaging options including custom boxes with client branding, supplier branded boxes, and blank unbranded boxes.

Made in the USA - Face Masks & N95 Respirators

We are selling 3-ply surgical and non-surgical face masks as well as N95 Respirators. The products are all manufactured in the USA, are FDA registered, and the N95 Respirators are receiving their NIOSH approval.

As the data becomes increasingly clear, face masks and N95 respirators help to prevent the spread of the novel Coronavirus. We are able to offer for large volume inquiries only at this time, subject to final confirmation:

3-ply masks - USD $0.50 / unit Ex-Works

N95 Respirators - USD $3.50 / unit Ex-Works

Pistachios

California’s pistachio crop is progressing well due to favorable weather conditions in recent weeks. Many sellers are currently assessing their sold positions and estimated new crop inventories to determine their strategy in making forward contracts. Pricing for the new crop is expected to remain stable, while global demand continues to stay high.

We supply both in-shell and pistachio kernels from California's highest quality packers.

Sunflower

Due to adverse weather conditions and a short crop in the 2019 harvest, much of the US sunflower industry is looking forward to the new crop harvest. Many buyers saw prices rise sharply from the opening of the season last year until now due to this unpredicted short crop.

We supply In-shell sunflower as well as hulled sunflower kernel available in premium and industrial grades for all major sizes. Packaging options include 10 KG, 25 lb, and 50 lb bags.

Cranberries

Both USA and Canadian cranberry crops are progressing well. The quality this year looks to be excellent. Demand for Sweetened Dried Cranberries (SDC) had softened in the early part of 2020 leading to lower prices with little increase in sales regardless. Demand has begun picking back up after what is traditionally a slower summer sales season, yet it remains to be seen how ongoing COVID-19 related disruptions will affect the coming new crop pricing. Many buyers at this stage are buying hand-to-mouth with only the larger buyers booking extended forward contracts.

We supply Conventional and Organic Whole or Sliced Sweetened Dried Cranberries (SDCs) packed in bulk cases as well as Organic Apple Juice Sweetened varieties. We also work with quarter inch diced and other diced cranberry products available as per client requirement. In addition, we supply 50 Brix and 65 Brix cranberry concentrate shipped in bulk 55 gallon drums.