Almonds

The Almond Board of California’s January 2020 position report marked a new record month for export shipments of California Almonds, continuing a bull run for the 2019/20 marketing year with records broken for export shipments in 3 of the last 4 months; October, November, and January respectively.

Prices have stabilized and the continued strong global appetite for California Almonds is unlikely to diminish after the traditional annual slowdown seen in February due to Asia’s lunar New Year celebrations. It remains to be seen if February will break another record for export shipments. Currently, YTD receipts sit around 2.5 billion pounds, with some predicting a final crop of 2.55 billion pounds.

With such strong shipments this marketing year, buyers and suppliers alike will be watching the California Almond bloom with a keen eye to better understand how this will affect crop production for the coming harvest. Many buyers will be examining their purchased inventories and weighing the news about the bloom from the fields in order to better understand their future contract demand. A large Nonpareil crop this year has helped to stabilize and even soften prices for other almond varieties. This large Nonpareil crop and the resulting substitution effect has led to a compression of, and the smallest differences between, Nonpareil prices and other almond varieties in a number of years.

Our most popular almond varieties are Nonpareil, Independence, Butte/Padre, and Carmel types with the most popular grades of Supreme, Extra, Standard 5%, and more.

Walnuts

The Walnut Board of California’s monthly shipment report for January 2020 was recently released, showing a marked decrease in export shipments vs January 2019; 59,755 tons exported in 2020, vs. 75,699 tons exported in 2019. Also of note was a year-over-year decrease in in-shell shipments in January of -73% for the United States and -86% for Canada. A vast change from just one year ago. Further, Europe and the Middle East/Africa regions also saw remarkable declines in their shipments for California in-shell products between January 2019 and January 2020.

The Asia / Pacific Rim region was the only region to record an increase in shipments between January 2019 and January 2020, +134% year-over-year. This is almost entirely due to the large increase in Vietnam’s imports of a whopping +544%! Vietnam, with a population of 95.5 million, was the Asian region’s 2nd largest importer behind only India, with a population of 1.3 billion. With China’s total imports down -75% between Jan 2019 & Jan 2020, it’s not hard to imagine Vietnam as an important, albeit illicit, corridor for Chinese importers looking to avoid the worst effects of tariffs from the US / China Trade War.

Due to a price run on in-shell products at the end of 2019 that may have exceeded the market’s capacity to absorb such large price increases, both Turkey and Italy are reporting large buyer defections. Many California packers have seen Turkish and Italian buyers walk away from contracted containers in their respective destination ports. This is an ongoing issue that is unlikely to find an easy resolution unless one side relents on price (typically unlucky suppliers held hostage by unscrupulous buyers).

We work with the best California walnut packers to supply our customers with Jumbo and Jumbo / Large (J/L) in-shell Chandler, Howard, Hartley, Vina, Tulare, Serr and other varieties. We also provide bleached in-shell walnuts in addition to California shelled product including Chandler and non-Chandler Light Halves & Pieces (LHP) 20%, 40%, 80% and higher based on customer requirements. We also supply Combo Halves and Pieces (CHP) and Light Sorted Pieces (LSP).

Pistachios

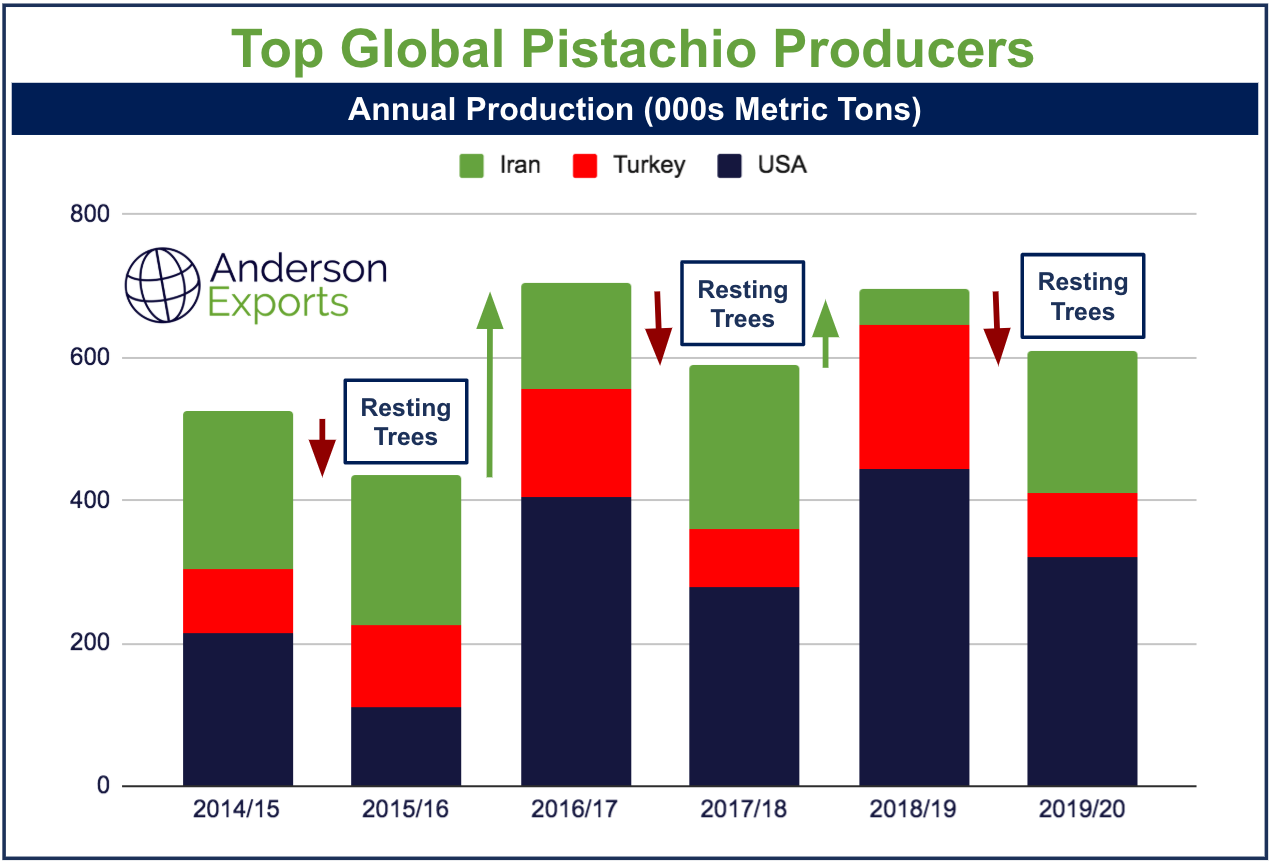

Production for the world’s top producers, the United States, Turkey, and Iran is projected to be down for the 2019 / 2020 season as the trees in the US and Turkey will enter their typical cyclical resting period.

According to data from the Administrative Committee for Pistachios, and the National Agricultural Statistics Service (NASS), 2020 U.S. production is predicted to decline by some 26 percent. As 2019/20 will be an off-year due to resting trees, the forecasted crop is around 332,000 tons. As reported by the USDA, as a result of the reduced output, “exports are forecast to drop 28 percent to 200,000 tons on lower shipments to top markets China and European Union. Ending stocks are expected to fall to a 5-year low of just 35,000 tons.”

We supply raw in-shell pistachios and raw pistachio kernels of all sizes, grades and styles. We also supply roasted Extra No. 1 pistachios and welcome your inquiries.

Soybeans

Sales of US origin soybeans are picking up again as China and the United States begin to implement the Phase One trade deal, reopening the largest market for US soybeans. American farmers are eager to get these shipments moving with expectations of prices remaining stable to encourage strong sales as the trade tensions of the last two years begin to ease.

We supply GMO and Non-GMO Soybeans and Soybean Meal of all sizes, grades and styles.

Raisins

Raisins sales continue to proceed apace with California packers seeing some much needed support as global demand picked up in 2020. Prices for California raisins have also seen relief as strong domestic and export sales help stabilize prices. It seems California raisins are set for a good marketing year in 2020 with investments being made domestically by Sun-Maid Raisins to entice millennial parents and many packers experiencing strong sales thus far in Q1.

We supply all major bulk California raisins including dried-on-the-vine (DOV) and tray-dried Natural Thompson Seedless Selects, Selma Petes, Flames, Goldens, and other varieties in Jumbo, Select, and Midget sizes and welcome your inquiries. We also supply Selma Pete DOV Double-Run Supreme raisins to Japan and elsewhere which are processed twice to achieve exceptionally low stem and capstem counts. We offer multiple packaging options including custom boxes with client branding, supplier branded boxes, and blank unbranded boxes.

Pecans

US Pecans have seen their first increase in prices in a number of years. The last price increase of note happened after the Hurricane season of 2018 due to uncertainty in regards to the potential damage these storms would cause in Georgia and other US states. The 2019 marketing year began with slower sales and lower prices. Due to strong domestic demand and even in light of reduced demand from China due to the US / China trade war, prices have begun to rise as the USDA reports a drawdown on monthly in-shell cold storage. The rise in prices seen recently is likely due to this strong domestic demand combined with a shorter than expected crop in Mexico and the Phase One agreement by US & China trade negotiators.

We supply Fancy Junior Mammoth Halves (FJMH), Fancy Mammoth Halves, Fancy Pieces, and other sizes / types for all major U.S. pecan varieties.

Sunflower

US Sunflower stocks have seen a large hit due to weather and a shorter than usual crop. As a result, buyers of US sunflower seed products have seen a sharp increase in the prices contracts have closed at in recent weeks as compared to the harvest’s lower opening prices. Expect this short crop to continue to buoy prices as those who made forward contracts in the fall will reap the benefits of this advantageous position. Buyers looking for prompt shipments or forward contracts now, or later in 2020, may find suppliers offering on a limited basis or simply unable to meet the demand.

We supply In-shell sunflower as well as hulled sunflower kernel available in premium and industrial grades for all major sizes. Packaging options include 10 KG, 25 lb, and 50 lb bags.

Cranberries

United States and Canadian supply has been shorter than expected this year, causing prices to rise for both sliced and whole SDC products. Those who made forward contracts are in a great position heading into the rest of 2020 as prices are likely to rise through this year and very likely into the 2020/2021 marketing year. If you have prompt needs or will need whole or sliced SDC in the coming months, I recommend making forward contracts earlier rather than later.

We supply Conventional and Organic Whole or Sliced Sweetened Dried Cranberries (SDCs) packed in bulk cases as well as Organic Apple Juice Sweetened varieties. We also work with quarter inch diced and other diced cranberry products available as per client requirement. In addition, we supply 50 Brix and 65 Brix cranberry concentrate shipped in bulk 55 gallon drums.

Poultry & Pork

China’s AQSIQ certified list of approved meat manufacturers has risen to 850 plants in 18 countries. You can explore the full list HERE.

We supply all major pork and poultry products from SIF certified factories approved by the Chinese AQSIQ. We supply Chicken Feet, Paws, Middle-Joint Wings, in addition to pork products.