August 5, 2018

Anderson Exports is a Bulk Ingredients Sourcing Agency in Northern California. We specialize in sourcing the best ingredients from California, Brazil and the rest of the world. Our newsletter delivers actionable market intelligence to inform our clients' purchasing decisions.

Raisins

The new crop of California raisins is developing well with improved bunch counts compared to last year and overall crop quality is looking good. At this time, we are signing up new crop contracts for earliest shipment in September and October.

Even with expectations of a normal new crop for California raisins, we anticipate elevated prices due to the smaller carry-in and backlog of demand. Since the prior crop was so small, the carry-out from this season is probably going to be approx. 70 - 75k MT for California Natural Seedless Select raisins.

We believe this decreased carry-in figure together with the shipment backlog -- seen in the June shipments down 39% year-over-year -- will lead to tight supply and firm prices for new crop despite normal production levels.

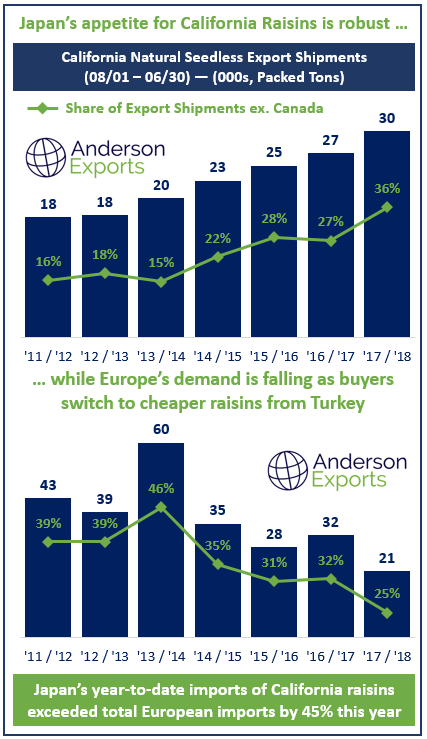

On the demand side, there is strong appetite for California raisins from Asia, particularly in Japan. Based on monthly shipment data from the Raisin Administrative Committee (RAC), the following graphic helps illustrate the shifting export demand for California raisins.

For the first time ever, Japan imported more California raisins than all of Europe over the period of August 1st to June 30th this year. Not only did Japan surpass European imports, it did so by a vast margin: 9,315 MT or 45%. We expect this robust demand from Japan to continue. Japan’s quality specifications are some of the strictest in the world and California’s processing facilities are the most sophisticated so the two regions are well-suited.

Over the last few years, Europe has become a less significant buyer of California raisins, opting increasingly for Turkish sultana raisins rather than California Thompsons, largely due to the price differential. Turkey’s proximity to Europe as well as improving processing capabilities are also driving the origin-shift.

The California Thompson is widely considered to be the best snacking raisin globally and will likely remain so for some time. We expect California raisin prices to remain elevated and buyers to act early to secure new crop material and welcome your inquiries for dried-on-the-vine (DOV) and tray-dried California Thompson Seedless, Selma Petes, Flames, Goldens, and others in Jumbo, Select, and Midget sizes.

Cranberries

The USDA decision on the 25% producer allotment (supply reduction) for the coming crop is long overdue at this time. They indicated the decision would be put out in Feb/March but has yet to be released. Growers need to make operating decisions with the information about the crop allotment since the implications will be severe. Availability remains tight with no prompt shipment available. Some suppliers are completely sold out of fruit and are awaiting new crop. At this time, the new crop looks okay -- doesn't appear to be the biggest crop but should be normal. Bottom line is that the USDA holds the cards on forward cranberry pricing due to the potential for the USDA to pass a 25% supply reduction for the coming crop. This decision has the potential to drive prices higher substantially.

With the earliest shipments being offered right now for September / October, and some suppliers offering January forward shipments well over $2.00 / lb. on an ex-works basis, our recommendation if you need to cover your cranberry needs prior to 2019, is to lock in contracts at today's prices.

Walnuts

Buyer apprehension due to uncertainty over trade tariffs is causing slower new crop sales for California walnuts. Prices have come down in recent weeks for current and new crop. Walnut handlers in California are looking to reduce inventories and accelerate new crop sales so prices are coming down. The new crop is expected to be healthy with tonnage in the 680,000 MT range. Though tariff-related uncertainty may persist for some time, we do expect order activity to pick up after the Objective Walnut Estimate is released later this month. The California Agricultural Statistics Service (CASS) Objective Estimate will add some clarity on the new crop.

Howard, Hartley, Bleached Hartley, Tulare, Vina, and Serr varieties of inshell walnut will be harvested first, with Chandler quick to follow. We are currently marketing new crop inshell Jumbo and Jumbo / Large Chandler Walnuts, please let us know your requirements.

Almonds

Almond prices are declining due to the tariffs effect of weakening demand. China's tariff added a 50% tax to California almonds. Prices have come down approx 10% recently due to the bumper crop expected amid lower demand due to escalating trade tensions. As another setback for U.S. almond growers, China has closed a trading loophole that for years allowed large volumes of American almonds to be transported into the country via Vietnam without incurring import taxes. China's strict treatment of smuggling is also discouraging transshipment activity to avoid tariffs.

Overall, we see committed shipments currently down >50% from this time last year as an early signal of prices dropping substantially in the period ahead due to the bumper crop amid eroding export demand due to tariffs.

Apricots

Turkish apricot shipments for the 2018 crop are underway and quality is good. Organic and non-organic sulfured and unsulfured Turkish apricots are available in size 3, 4 and 5 are freshly processed and packed. With production for the 2017 / 2018 harvest estimated in the 140,000 MT range, Turkey is by far the largest producer of apricots globally followed by Iran (32,000 MT) and Uzbekistan (10,000 MT).

Brazil Sugar

Weak sugar prices continued in recent weeks as world market surpluses rose further. Earlier this year, record production from India and Thailand worsened the oversupply situation. Production in the E.U. is also growing after production quotas expired in October 2017. The E.U. faces an extremely competitive export market with global production so high and prices so low. In recent weeks, heavy rains in the Center / South Brazil slowed the sugarcane crush. Wetter weather is known to negatively impact cane quality and incentivizes ethanol production since juice quality deteriorates.

We supply Brazil origin ICUMSA 45 Sugar by the vessel on a spot (MOQ: 50,000 MT) or forward contract basis including long-term contracts of 300,000 MT / month x 12 months. Payment by SBLC, BG, or DLC from global top 50 bank.

Brazil Soy

As Trump escalates the trade war with China, Brazil and Argentinian soy farmers are seizing the opportunity to increase production. The USDA raised its 2018 / 2019 Brazilian production forecast to a record 120.5 MMT driven by higher planted soybean acreage.

Higher freight rates in Brazil are continuing to negatively impact Brazil’s soybean industry. Due to higher inland freight costs as a result of the labor disputes, fertilizer deliveries to Brazilian soybean growers have been delayed. Some growers have reported a rise in fertilizer and pesticide costs of 20% ahead of the 2018 / 2019 crop cycle. Higher fertilize prices will weaken grower margins and may lead to lower fertilizer application rates. In turn, reduced fertilizer and pesticide application rates may depress yields in the years to come. Despite near-term challenges, global demand is growing for soybeans and Brazil is extremely well positioned to serve increasing global demand.

We supply GMO and Non-GMO certified Soybeans from Brazil. MOQ: 50,000+ MT. Payment by SBLC, BG, or DLC from global top 50 bank.

Brazil Corn

Expectations for Brazil’s safrinha corn production fell in recent weeks. Many believe the lower production figures will be reflected in lower volumes of Brazilian corn exports. Reduced production is causing prices to go higher. Estimates for Brazilian production are in the 80 MMT range. Globally, corn inventories are falling faster than expected which is also firming prices. The global stocks to uses ratio is in the 13% range which is the lowest level in recent years.

We supply GMO and Non-GMO certified Corn from Brazil. MOQ: 50,000 MT. Payment by SBLC, BG, or DLC from global top 50 bank.

Other Products

We work with a number of other products so please reach out if you have an inquiry for something you do not see here. Some of our other product offerings include sunflower seeds, lentils, green peas, freeze dried fruits, popcorn, dried cherries, dried apples, dried blueberries, cherry concentrate, quinoa, dried honey dates, dried cherry tomatoes, dried gojis, dried kiwis, dried strawberries, chickpeas, chia seeds, dried mulberries, almonds, macadamias, pistachios, walnuts, cashews, pinenuts, pecans, brazilnuts, pumpkin seed kernels, melon kernels, hazelnuts, dried prunes, golden raisins, sultanas, dried apricots, sweet apricot kernels, dried blackcurrants, dried figs, dried dates, popcorns, maraschino cherries, dried tomatoes, strawberry pie filling, blueberry pie filling, cherry pie filling, dried mangoes, dried gingers, dried pineapple, and dessicated coconut.

Work With Us As a Supplier

We are always looking to grow our supplier base with companies capable of delivering continuous high quality product at large volumes. If you are interested, please reach out and introduce yourself.

We welcome your inquiries and look forward to working together to deliver you the highest quality ingredients from the world's best suppliers. We are available to our suppliers and buyers 24/7 over email, phone, or WhatsApp.